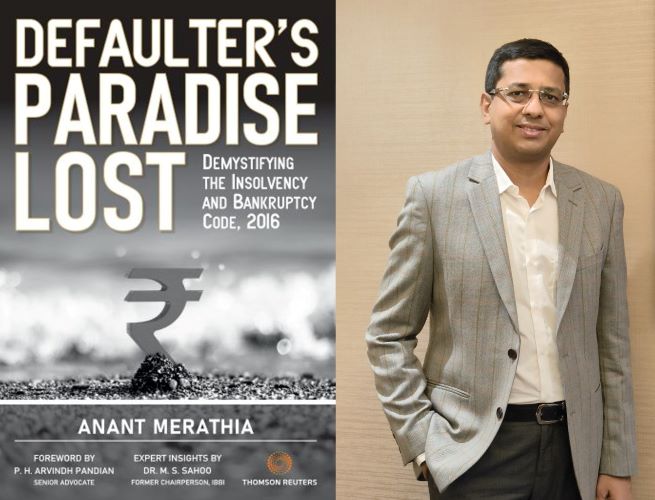

A comprehensive and practical guide to understanding IBC 2016

Defaulters Paradise Lost, and its author Anant Merathia

Team L&M

Defaulter’s Paradise Lost (Thomson Reuters) by Anant Merathia focuses on the Insolvency and Bankruptcy Code (IBC) introduced in India in 2016. Lucid and understandable, this book aims to provide a comprehensive and practical understanding of the IBC’s impact on the resolution process for financially distressed companies.

Drawing from his experience in legal practice, Merathia aims to present the evolution and dynamics of the IBC for common people. The book is structured to guide readers about different aspects of IBC without any legal jargon.

Presenting here excerpts from Chapter 4 of the book:

KEY STAKEHOLDERS AND ISSUES

To get a better grasp of how IBC operates, one needs to understand who are the key stakeholders involved and the broad challenges concerning them. As mentioned in an earlier chapter, the IBC introduced a completely new ecosystem, added a new set of terms and created new bodies and positions. While many of these have evolved to a reasonable extent, and some are still evolving. In this chapter, the relevant stakeholders are introduced to the readers to have a better understanding of their roles, obligations and challenges going forward.

CHALLENGES FACED BY THE CORPORATE DEBTOR

The company undergoing corporate insolvency process under IBC is known as the ‘Corporate Debtor’ (CD). It includes both private and public limited companies as well as the listed companies and LLPs. While on this, it is clarified that there is no exemption available to Government companies from being brought under this Code as on March 2023.There have been cases filed and even admitted against Government-owned companies. This issue has been settled by the Hon’ble SC in Hindustan Construction Company Ltd & Anr.v. Union of India & Ors.

It is important here to differentiate the CD and the business itself from the promoter per se. As much as both are intertwined in the manner in which Indian businesses operate, at this point it is imperative to look at it from a slightly different perspective. The objective of the Code is to ensure value maximization and revival of a company during stressed financial times.

However, there is a perpetual tug of war between the various stakeholders inter sesuch as the lenders, promoters, insolvency professionals, trade creditors and a few others who will be covered in this chapter. It is seen in some cases that this turns out to be counterproductive and the very objective of the Code is defeated when a company slips into liquidation or possibly dissolution. Many resolution processes have been marred by constant litigation between these stakeholders.

The promoter, who is most attached to the company, is barred from putting forth a resolution plan under provisions of the Code because of certain parameters, though there are exceptions to this rule. In all of this, ultimately, the business suffers, and the company in a way becomes an orphan and loses its value.

THE POSITION AND ROLES OF PROMOTERS/MANAGEMENT DURING PRE- AND POST-CIRP

The relevance, importance and role of an Indian promoter can never be undermined, not only in the context of IBC but also businesses at large. As discussed in Chapter 1, most Indian companies are typically closely held and/or are family-run and belong to the MSME sector or are even smaller than that. The percentage of companies that are professionally managed and come under the true corporate sector would certainly be minuscule in the overall scheme of things.

In many cases, the corporate entities are a result of hard work put in across generations, and the promoters in India, given their attachment to their companies, are mostly not prepared to let go and accept the fact that at times the challenges, especially the financial concerns and the debt exposure of the company, could have reached a stage which is probably beyond their control.

In the context of IBC, it is seen at the ground level that there is sometimes a constant tug of war between the promoter and the IP/CoC over several issues such as non-cooperation and so on. To be fair to all the stakeholders, it would be unreasonable to make any statement as to who is right or wrong as it is purely dependent on a case-to-case basis. This is where courts come to the rescue by resolving the issues between the stakeholders.

Akin to a coin having two sides, a promoter should not automatically be categorized in a blanket manner as someone with wrong intent, which, unfortunately, seems to have become the sentiment and thought process of many. At the same time, it is true that most promoters try their best to regain control over the company until the last possible opportunity is exhausted for various reasons – some good, some maybe not.

The Code mandates the promoters to constantly cooperate through the insolvency resolution proceedings failing which adverse consequences could be faced by them. It is also seen that often the promoter does not understand the repercussions and implications of this law, and it is too late by the time they realize the same. Thus, creating awareness about the legal ramifications of non-cooperation by the promoters is also a key task.

Though resolution is the intent of the Code, there are hurdles wherein promoters are barred from bidding for their companies under the resolution process, albeit with some relaxations. The said scenario extends in the case of liquidation also. The same has been addressed by the courts, and the law of the land on ineligible promoters being ousted is as follows:

• The Hon’ble SC, in the case Swiss Ribbons Pvt. Ltd. & Anr.v. Union of India & Ors, held that the ‘primary focus of the legislation is to ensure revival and continuation of the CD by protecting the CD from its own management and a corporate death by liquidation’.

• In Arun Kumar Jagatramkav. Jindal Steel and Power Ltd. & Another, the Hon’ble SC held that the promoter, if ineligible under Section 29A, cannot make an application for a Scheme of Compromise and Arrangement during liquidation.