Team L&M The Hotel Association of India has stated that hospitality sector has once again been ignored in the current GST reforms. The structural reforms, including reduction of the number of slabs were a need of the hour and are welcome. The rate on hotel accommodation priced at ₹7,500 and below from 12% to 5% […]Read More

Team L&M After the 56th meeting of the GST Council, the central government has made a big announcement for patients. Finance Minister Nirmala Sitharaman, during a press conference, stated that GST has now been completely removed from 33 life-saving drugs. Earlier, these drugs attracted 12% GST. These include medicines used in the treatment of cancer […]Read More

Team L&M In the 56th meeting of the GST Council, several major decisions were taken to provide big relief to patients and the general public. The GST on several essential medical products, which was earlier 18%, has now been reduced to 5%. This includes crucial equipment like thermometers, medical-grade oxygen, all diagnostic kits and reagents, […]Read More

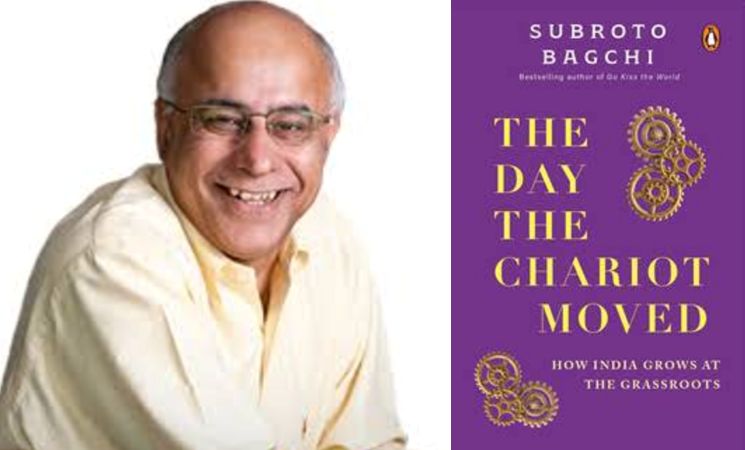

Rajkumari Sharma Tankha Subroto Bagchi’s memoir The Day the Chariot Moved (Penguin Publishers) is nothing if not inspiring. As one of India’s leading business minds and philanthropists, the author has inspired a new India, guided businesses in the nation, motivated its talent. This book is about the transformation of Odisha. It challenges us to look […]Read More

Anuj Puri The forthcoming GST changes, which will go into effect from September 22, 2025, will have a positive impact on the Indian residential, retail, and office real estate sectors. Residential Real Estate Lower construction costs – Reduced GST on construction materials like cement can reduce construction costs by as much as 3-5%. Developers, especially those […]Read More