Soham Majumdar

The Covid-19 pandemic has brought the world to a complete halt, almost forcing us to pay heed, stand, stop, and stare. The little escapes, those little wholesome moments that we used to yearn for, from amidst our busy daily schedules, have now become all that we are left with. As individuals, businesses and organisations grapple with the challenges of adapting themselves to the new normal, as we unlearn, relearn, reinvent ourselves in a desperate attempt to sail against the tide, disruptions are bound to occur on a massive scale. When resilience becomes the only available option, innovation takes precedence and dominance.

There is no doubt that the extended lockdown and the mandatory stay-at-home had resulted in businesses facing massive losses, due to the unavailability of labour and shrinking demand from the consumer side. This significant drop in revenues and falling demand have already started to translate into job losses and pay cuts. Experts opine that there has been a direct output loss of more than 8% and a possible fall in the gross domestic product in the current fiscal up till March next year. The recession the world is facing today is akin to the Great Depression and the 2008 global financial meltdown, in terms of magnitude and impact.

Closer home, India’s forex reserves are drying up, the rupee has taken the burn, cross border trade and exports have come to a sudden halt, and uncertainty looms large across all quarters. The revival and recovery are going to be a prolonged and arduous task and it will take years for the logistics and supply chain to return back to normalcy so that the demand-supply gap can be bridged.

Some of the worst-hit victims of the pandemic are sectors such as tourism, IT, hospitality, automotive, and real estate, and no near short term recovery is being anticipated. Automotive and real estate sectors were already facing strong headwinds before the pandemic struck us unguarded. Similarly, the sale of homes, jewellery, clothing and footwear, furnishings, etc will take a huge hit due to the liquidity crunch and the general aura of uncertainty and low reverbing consumer sentiments.

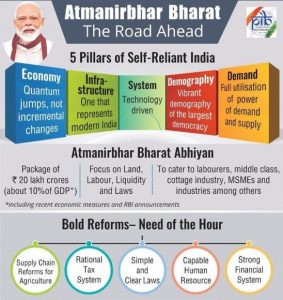

Though the Finance Minister recently distributed the Rs 20 lakh crore economic stimulus package under the Atma Nirbhar Bharat Abhiyan of the Government, much more could have been done to accelerate demand in the market. Increasing consumer spending and reviving demand is the most viable way to bring the economy back on track quickly. In order to keep the economic engines running, bold reforms and light-touch regulations will go a long way in building a self-reliant and sustainable India.

Also, the Indian real estate sector, one of the prime economic generators of the country have been struggling for several years. Liquidity injections would be a welcome move. Similarly, SMEs and unorganised sectors will also face problems short to medium term because of dilapidating finances and migrant laborers rushing back to their homelands. In the long term, however, things can look up on the back of proactive steps from the Government, promotion of FDI and adoption of the 17 sustainable development goals laid down by the UN. While the Government’s bailout package has put in money into the agricultural sector, the farmers, the poor and India’s small businesses and the NBFC sector, much has to be done for the country’s massive informal sector where many of them do not have a steady source of income.

As we approach a new world order, keeping our eyes and ears closer to the ground, increasing internet penetration and rapid digitisation will create several new jobs across industries. Newer business opportunities in healthcare, pharma, telemedicine, app-based distribution of medicine, e-commerce, m-commerce, social commerce, e-learning, online office solutions, robotics and drone-based logistics, specialised tech services, organic farming, manufacturing, etc will emerge.

Technologies such as IoT AI, AR, VR, cloud computing, automation and robotics are poised to compliment human workforce of the future, if not replace them altogether. As companies will be required to monitor their employees’ body temperature, observe social distancing norms, provide them with protective gear, and provide additional medical insurance and other additional services, many will look at employing automated tools and processes. While many may opine that such investments are capital intensive and given the liquidity shortage in the market, such investments may not be a judicious alternative to pursue. However, historical evidence suggests otherwise.

Many processes in manufacturing, logistics and industrial production side can be automated and intelligent supply chain planning tools and production automation can improve productivity and cut costs to a great extent. In immediate times, it is imperative to increase investments in key public sectors and healthcare facilities and services.